us germany tax treaty summary

Summary of Imports and Exports between the treaty country and the US. The rate is 15 10 for Bulgaria.

Germany Usa Double Taxation Treaty

Under Circular 802021 there is a separate clause providing guidance on claiming tax treaty benefits including the procedures and documents required for the submission.

. If the payor knows or has reason to know that an owner of income is not eligible for treaty benefits claimed the payor must not apply the treaty rate. 30 for Germany and Switzerland for contingent interest that does not qualify as portfolio interest. Summary of US tax treaty benefits.

However the exceptions to the saving clause in some treaties allow a resident of the United States to claim a tax treaty exemption on US. Protect against the risk of double taxation where the same income is taxable in 2 states. Double taxation treaties are agreements between 2 states which are designed to.

Not all countries impose a capital gains tax and most have different rates of taxation for individuals versus corporations. A capital gains tax CGT is a tax on the profit realized on the sale of a non-inventory assetThe most common capital gains are realized from the sale of stocks bonds precious metals real estate and property. A church tax is a tax collected by the state from members of some religious denominations to provide financial support of churches such as the salaries of its clergy and to pay the operating cost of the church.

If you are an applicant from a treaty country such as Germany the enterprise itself possesses treaty country nationality and the enterprises activities constitute trade within the meaning of the Immigration and Nationality Act you may qualify for an E-1 visa. Print corporate tax summary. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income.

United States 1 2 10. The rate is 15 for interest. However the payor is not responsible.

A church tax is collected in Austria Denmark Finland Germany Iceland Italy Sweden some parts of Switzerland and several other countries. Notably a formal review and approval process is now introduced.

Double Taxation Taxes On Income And Capital Federal Foreign Office

The Dawes Plan 1924 The Young Plan 1929 How To Plan German Propaganda Lent

International Corporate Tax Reform Dgap

Germany Adopts Substantial Transfer Pricing And Anti Treaty Shopping Rule Changes Mne Tax

Germany S Coalition Agreement Deloitte Legal Germany

The Ins And Out Of Us Taxation For German Citizens

Donald Trump Approves Plan To Pull 9 500 Troops From Germany News Dw 01 07 2020

Status Of Forces Agreement What Is It And Who Is Eligible Article The United States Army

International Corporate Tax Reform Dgap

Us Military In Germany To Create List Of People Targeted By Local Tax Authorities In Spite Of Sofa Status Stars And Stripes

New German Government To Permit Dual Nationality Schengenvisainfo Com

What Is The U S Germany Income Tax Treaty Becker International Law

United States Germany Income Tax Treaty Sf Tax Counsel

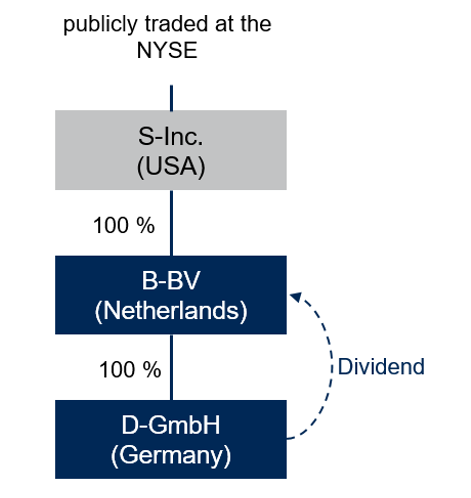

German Law Removes Us S Corporation Tax Benefit

The Political Structure Of Germany Simple And Clear

Ukraine Gets Compensation In Exchange For Us Germany Deal On Nord Stream 2 Euractiv Com