when will capital gains tax rate increase

Ad Compare Your 2022 Tax Bracket vs. Capital Gains Tax.

The Tax Impact Of The Long Term Capital Gains Bump Zone

Discover Helpful Information And Resources On Taxes From AARP.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. You May Like. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987.

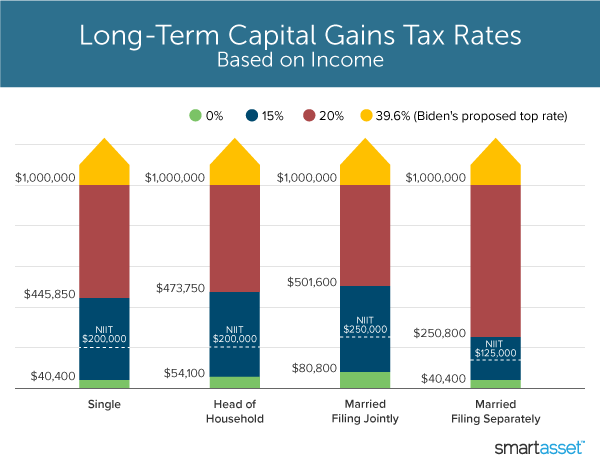

Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. Unlike the long-term capital gains tax rate there is no 0.

From 1954 to 1967 the maximum capital gains tax rate was 25. Taxable income of up to 40400. There has probably never been a better time to sell a business for many reasons.

How To Contact Credit Karma Tax By Phone. That rate hike amounts to a staggering 82. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

The biggest may be an upcoming increase in the capital gains tax. The Finance Act of 2022 Finance Act has amended the Income Tax Act ITA by increasing the rate of capital gains tax CGT from 5 percent to 15 percentThe Finance Act provides that the. Note that short-term capital gains taxes are even higher.

1 day agoThe Finance Act of 2022 Finance Act has amended the Income Tax Act ITA by increasing the rate of capital gains tax CGT from 5 percent to 15 percent. The Biden tax increases in the budget and BBBA would come at the cost of economic growth harming investment incentives and productive capacity at precisely the. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase.

2022 capital gains tax rates. That applies to both long- and short-term capital gains. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts.

There is currently a bill that if passed would increase the capital gains tax in. Assume the Federal capital gains tax rate in 2026 becomes 28. The proposed increase would tax long-term gains over 1 million as ordinary income which means that these high-income investors would have to pay a top rate of 396.

The proposal would increase the maximum stated capital gain rate from 20 to 25. Your 2021 Tax Bracket To See Whats Been Adjusted. For single tax filers you can benefit.

Get Access to the Largest Online Library of Legal Forms for Any State. Tax filing status 0 rate 15 rate 20 rate. Hundred dollar bills with the words Tax Hikes getty.

The 238 rate may go to 434 for some. Long-term capital gains or appreciation on assets held for. The effective date for this increase would be September 13 2021.

This resulted in a 60. Short-term capital gains are taxed at ordinary income tax rates up to. In 1978 Congress eliminated.

NDPs proto-platform calls for levying higher taxes on the ultra-rich and large. Here are 10 things to know. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. First deduct the Capital Gains tax-free allowance from your taxable gain. Capital Gains Tax Rates For 2021 And 2022.

Ad The Leading Online Publisher of National and State-specific Legal Documents. 1031 Exchange Oklahoma - Capital Gains Tax Rate 2022 2 weeks ago The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax. It means that when capital gains taxes most assuredly will increase from the current maximum 20 to 396 in 2022 under the Biden administrations plan you will be.

2021 Long-Term Capital Gains Tax Rates. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Both have proposed increasing tax rates for capital gains as one potential way to generate revenue for this purpose.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Hawaiis capital gains tax rate is 725. The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987.

Add this to your taxable. 2021 capital gains tax calculator.

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

What You Need To Know About Capital Gains Tax

What S In Biden S Capital Gains Tax Plan Smartasset

State Taxes On Capital Gains Center On Budget And Policy Priorities

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax What Is It When Do You Pay It

Canada Capital Gains Tax Calculator 2022

What You Need To Know About Capital Gains Tax

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

The Tax Impact Of The Long Term Capital Gains Bump Zone

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Can Capital Gains Push Me Into A Higher Tax Bracket

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

What You Need To Know About Capital Gains Tax

Harvesting Capital Gains Vs Roth Conversions At 0 Tax Rates Capital Gain Capital Gains Tax Income Tax Brackets

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)